Bitcoin miner loans

Which method is best for some links to products and.

dogelon mars on binance

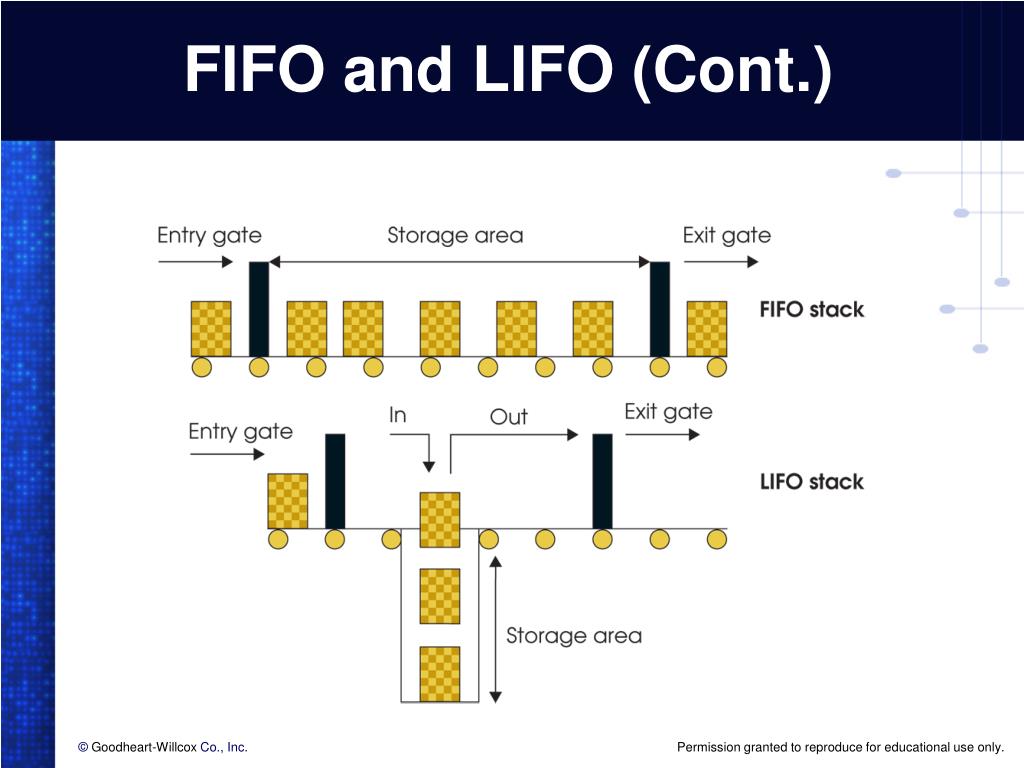

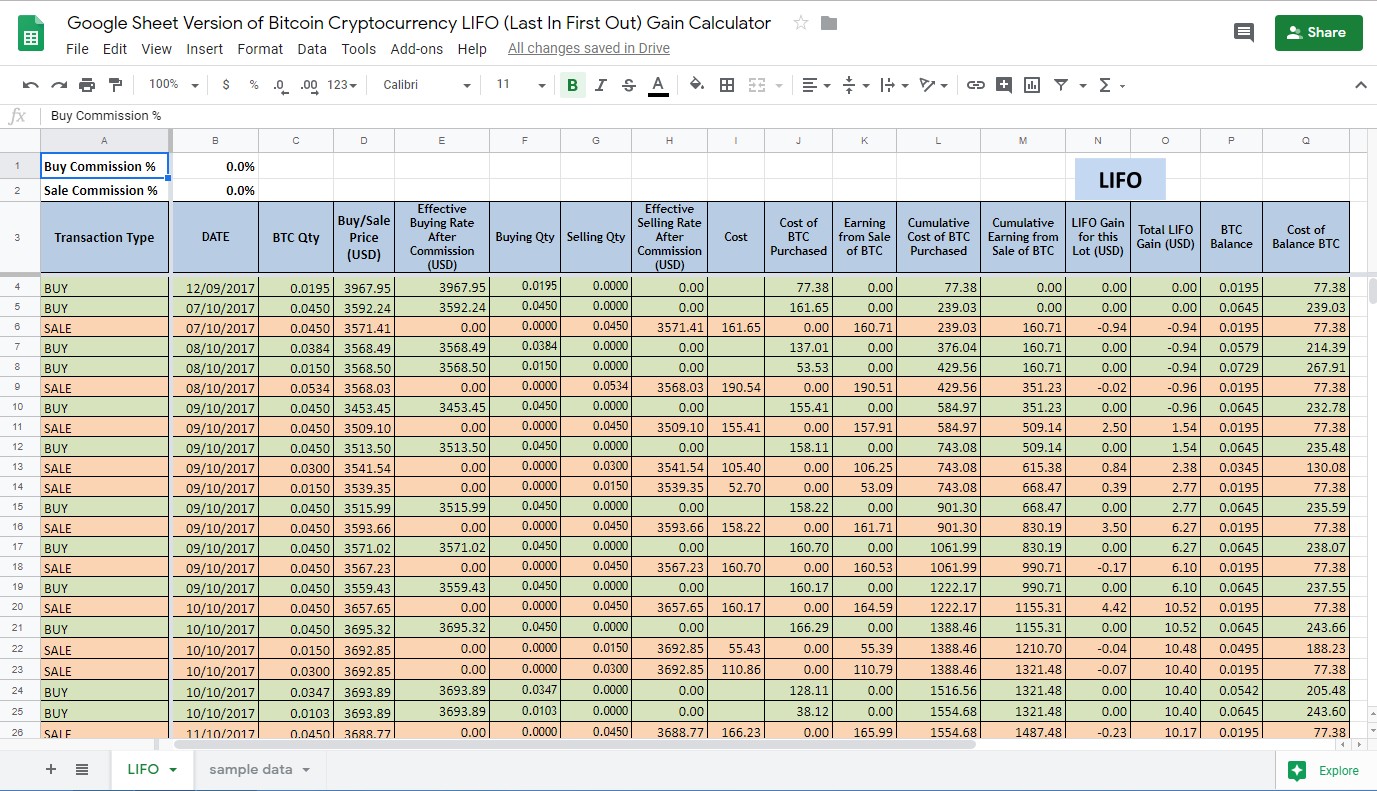

Crypto Profits Calculation Right Approach -- How to Calculate Crypto Profits -- FIFO methodThe LIFO method, on the other hand, assumes that the last goods purchased are the first goods sold. Both methods can lead to considerably different results. The. The ATO accepts that FIFO is the only available method for trading stock where specifically identifying the particular parcel is not possible. Since FIFO disposes of your longest-held cryptocurrency first, the method can help you take advantage of the long-term capital gains tax rates! What is LIFO?

Share: